If there’s one gaming company that defined the chaos and ambition of the last decade in gaming, it’s Embracer Group.

From buying Tomb Raider and The Lord of the Rings to shutting down beloved studios and canceling high-profile games, Embracer’s rise and fall reads like a blockbuster script. In just a few years, it went from an obscure Swedish game publisher to a global giant – and then collapsed under the weight of its own empire.

But that’s not where the story ends.

This article breaks down everything you need to know about Embracer: how it grew, what it owns, what went wrong, and where it’s headed next.

Who Is Embracer Group?

Embracer Group is one of the most talked-about companies in the gaming industry – and not just because of its size.

Based in Sweden and led by entrepreneur Lars Wingefors, Embracer started out as Nordic Games in the early 2000s, selling secondhand video games. Over the years, it evolved into a global force through a string of bold acquisitions and rebrands, eventually adopting the Embracer name in 2019.

Today, Embracer isn’t just one gaming company – it’s a group made up of multiple operating divisions. These include names like THQ Nordic, Coffee Stain Studios, Plaion, Deca Games, Dark Horse Media, and more. Through these arms, Embracer has published or distributed games across nearly every genre and platform you can think of.

At its peak, Embracer owned over 130 internal studios and managed hundreds of IPs, including AAA franchises and indie hits alike. Its reach even extended beyond video games into comics, film, and tabletop games, thanks to acquisitions like Dark Horse Media and Asmodee.

But it hasn’t all been smooth sailing.

After years of expansion, a $2 billion deal collapsed in 2023, leading to a major restructuring effort. Despite these challenges, Embracer remains one of the most ambitious and fascinating companies in gaming – and it’s now setting the stage for its next chapter by splitting into three separate companies.

Embracer Group Key Acquisitions and Expansion

Embracer didn’t grow slowly. It exploded.

The company went on one of the most aggressive acquisition sprees the gaming world has ever seen – buying up developers, publishers, and IPs at a dizzying pace.

It all started with smaller deals in the early 2010s. After picking up assets from bankrupt publishers like JoWooD and THQ, Embracer (then still operating under the THQ Nordic name) began reviving legacy franchises and building its reputation as a company that brought forgotten titles back to life.

Then things got bigger. Much bigger.

From 2018 onward, Embracer acquired:

- Koch Media/Deep Silver, giving it access to franchises like Metro and Saints Row

- Coffee Stain Studios, the team behind Goat Simulator and Satisfactory

- Saber Interactive, which brought with it World War Z and a number of support studios

- Gearbox Entertainment, makers of Borderlands

- Aspyr, Dark Horse Media, CrazyLabs, and even Middle-earth Enterprises, which controls The Lord of the Rings media rights

By the end of 2022, Embracer had spent billions to build a gaming empire with more than 130 studios and over 800 projects in development.

But the breakneck pace came with a cost. When a $2 billion deal collapsed in 2023, Embracer was left with major debt and forced to sell or close many of the companies it had just acquired.

Even after the sell-offs, what’s left is still massive.

What Games and Franchises Does Embracer Group Own?

As of mid-2025, Embracer – or more specifically, the new company “Fellowship Entertainment” – still owns a wide range of titles across platforms.

Here are some of the most well-known:

Franchises

- Tomb Raider

- Deus Ex

- The Lord of the Rings / The Hobbit

- Darksiders

- Killing Floor

- Metro

- Kingdom Come: Deliverance

- Dead Island

- Remnant

- Red Faction

- TimeSplitters (though the planned reboot was canceled)

- Legacy of Kain

- Alone in the Dark

- Titan Quest

- Destroy All Humans!

- Jagged Alliance

- Saints Row (though its future is uncertain after Volition closed)

Mobile Games

- Super Stylist and other titles from CrazyLabs

- Games by Deca Games and IUGO Mobile

- Puzzle and casual games from Easybrain (until its 2025 sale to Miniclip)

Video Games / Studios with Key IPs

- Tarsier Studios (Little Nightmares)

- Flying Wild Hog (Shadow Warrior)

- Gunfire Games (Remnant II)

- Plaion (publishing label with games like Dead Island 2)

- THQ Nordic (home to Elex, Biomutant, and more)

- Crystal Dynamics and Eidos-Montréal (developers of Tomb Raider and Deus Ex)

- Dark Horse Games (games based on comic IPs like Hellboy and Sin City)

Even though Embracer has offloaded some heavy hitters – like Borderlands (with Gearbox now under Take-Two) – it still holds more than 300 active IPs and a diverse mix of console, PC, and mobile games.

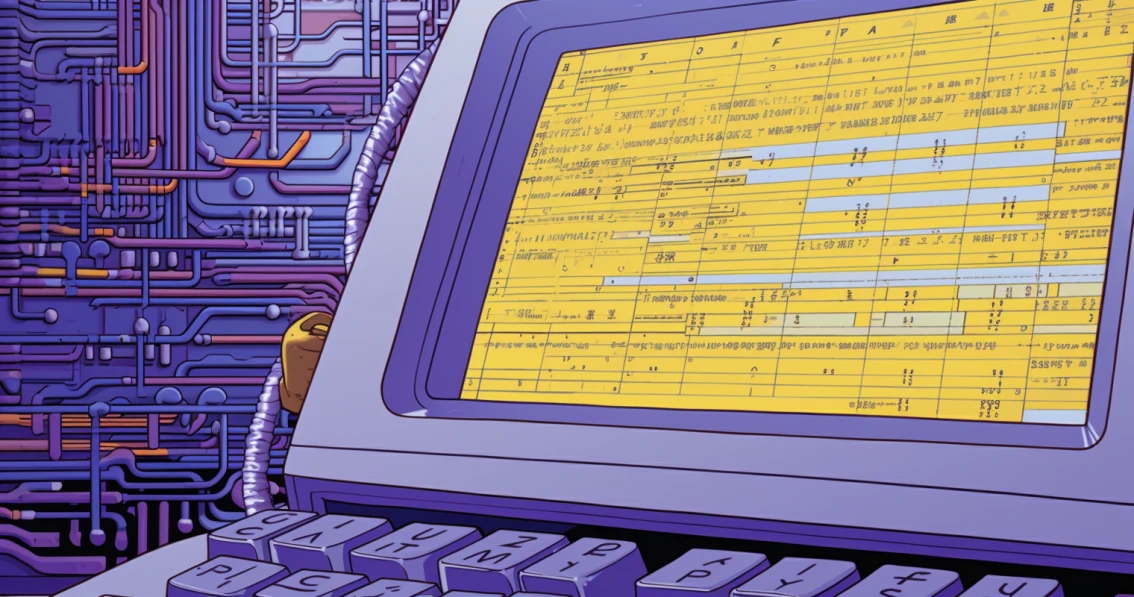

Embracer Group Revenue

Let’s break down how Embracer has performed financially over the past few years.

In fiscal year 2023/24 (April 2023 to March 2024), Embracer reported record net sales of SEK 42.2 billion (around $3.7 billion USD), with an adjusted EBIT of SEK 7.1 billion and free cash flow of SEK 1.5 billion (Embracer Group, 2024).

However, things changed quickly.

For fiscal year 2024/25, Embracer’s net sales dropped to SEK 22.4 billion (about $2.0 billion USD), marking an 18.6% year-over-year decline (Embracer Group, 2025). Q4 revenue alone was down 7.5% compared to the same period the previous year (Embracer Group, 2025).

As of mid-2025, its trailing twelve-month revenue is estimated at $2.8 billion, down from $3.6 billion in 2023 (CompaniesMarketCap, 2025).

What This Tells Us

- Explosive growth: Embracer’s revenue surged between 2022 and 2024 thanks to dozens of acquisitions and major IP deals (Embracer Group, 2024a).

- Post-crash slowdown: After a $2 billion investment deal collapsed, Embracer had to restructure. That included studio closures, layoffs, and divestments – all of which hit revenue hard (Embracer Group, 2025).

- Strategic reset: Embracer is now shifting toward a more focused model. The goal is to boost profitability by concentrating on fewer, stronger franchises (Embracer Group, 2025).

Financial Challenges and Restructuring

By mid-2023, Embracer’s rapid rise started to fall apart.

The turning point? A $2 billion investment deal–widely believed to be with Saudi Arabia’s Savvy Games Group–collapsed at the last minute (Axios, 2023). This deal was expected to fund a wave of new games, including projects in the Turok and Jurassic Park franchises.

But when the deal fell through, it left Embracer with over $2 billion in debt–and no way to fund the massive operation it had built.

So, the company hit the brakes. Hard.

Between 2023 and 2025, Embracer:

- Laid off 7,800 employees

- Closed 44 studios

- Canceled 80 in-development projects, including a new Deus Ex, TimeSplitters, and Red Faction game (Bloomberg, 2024; Embracer Group, 2024b)

Big-name studios like Volition (Saints Row) and Free Radical Design (TimeSplitters) were shut down. Others, like Saber Interactive and Gearbox Entertainment, were sold off entirely.

The restructuring hit almost every part of Embracer’s empire, from indie developers to legacy brands. In total, the company reduced its headcount from 15,700 to under 7,900 by the end of 2024 (Embracer Group, 2024b). (For a detailed overview, read our article on Embracer Group layoffs.)

Now the focus became survival. According to CEO Lars Wingefors, Embracer isn’t chasing new deals anymore. The new plan is simple: make better games, spend less money, and improve cash flow (Embracer Group, 2024b).

Splitting the Empire: Embracer’s Three New Companies

After months of downsizing and selling off studios, Embracer Group made a bold decision in April 2024: it would split into three separate, publicly traded companies (Embracer Group, 2024c).

The idea? Let each part of the business focus on what it does best, without being dragged down by the weight of the whole.

Here’s how the split looks:

1. Fellowship Entertainment

This is the largest piece and will carry forward Embracer’s legacy as the legal successor to the original company.

It holds Embracer’s biggest franchises and studios, including:

- Tomb Raider

- The Lord of the Rings / The Hobbit

- Metro, Dead Island, Killing Floor, Darksiders, Remnant, and more

- Studios like 4A Games, Crystal Dynamics, Eidos-Montréal, Gunfire Games, THQ Nordic, Plaion, and Dark Horse Media

Fellowship Entertainment will focus on AAA titles and IP licensing, including work across gaming, film, and TV.

2. Coffee Stain & Friends

This group covers indie and AA games, especially those with strong community backing.

It includes:

- Coffee Stain Studios (Goat Simulator, Satisfactory)

- Ghost Ship Games (Deep Rock Galactic)

- Tuxedo Labs (Teardown)

- Plus select Scandinavian studios from Amplifier Game Invest

This company is all about creativity, quirky hits, and staying close to player communities.

3. Asmodee Group

This is Embracer’s board game and card game powerhouse. It includes more than 20 studios and publishes massive tabletop hits like:

- Catan

- Ticket to Ride

- 7 Wonders

- Carcassonne

While often overlooked in gaming discussions, Asmodee is one of the biggest players in physical games globally.

All three companies will be owned by a new holding company, Embracer AB, and led by Lars Wingefors, who will stay on as CEO (Embracer Group, 2024c). The split is expected to be completed by the end of 2025.

It’s a huge shift – but one designed to simplify operations, give each division breathing room, and restore investor confidence.

Final Thoughts on Embracer Group

Embracer Group’s story is one of ambition, reinvention, and hard lessons.

It grew from a humble reseller of used games into one of the largest video game holding companies in the world. Along the way, it snapped up legendary franchises, built a global studio network, and made headlines with billion-dollar deals.

But the crash that followed proved that growth without limits isn’t sustainable.

After layoffs, closures, and a complete reset, Embracer is no longer the all-consuming empire it once was. Instead, it’s evolving into three focused companies – each with a clear mission and more manageable scope.

Whether that shift brings long-term stability or not remains to be seen. But one thing is clear: Embracer changed the gaming industry – and it’s not done yet.

Explore More Leading Game Publishers

Data Sources

- Embracer Group. (2024). Annual Report 2023/2024.

- Embracer Group. (2025). Q4 2024/25 Financial Presentation.

- Embracer Group (2025). Embracer Revenue.

- Wikipedia. (2024–2025). Various entries including Embracer Group, Slipgate Ironworks, Piranha Bytes, and Eidos-Montréal.

![100 Most Downloaded Mobile Games of All Time [2026 Update]](/static/99afae46062235e3169a5215ce144b16/0ccb9/subway-surfers-game-design.png)